Imagine cutting years off payment system setup. The number of Payment Facilitators (PayFacs) has grown 13.8% each year since 2018. This shows how fast this model is growing.

For businesses, this means they can use payment systems without starting from scratch. PayFac as a Service lets companies add payment processing to their platforms. This turns payments into a way to make money, not just a cost.

Traditional payment models make businesses rely on third-party providers. But PFaaS changes this. With PFaaS, you can start using sub-merchants in just one day. You can also accept many payment types, like credit cards and digital cash, without huge upfront costs.

This change isn’t just about making things easier. It’s about making money. Global embedded payment revenue is expected to reach $59 billion by 2027. This is up from $32 billion in 2023. It shows how important it is for companies to own their payment flows today.

Key Takeaways

- PayFac as a Service reduces PayFac setup time from years to days, slashing costs by millions.

- Businesses using PFaaS gain access to 20+ payment methods, including e-wallets and bank transfers.

- Embedded payments revenue will grow 84% by 2027, driven by PFaaS adoption.

- PFaaS providers handle PCI DSS compliance, freeing businesses to focus on core operations.

- PayFacs earn up to 1% of processed payment volume, turning payment infrastructure into a revenue stream.

What Is PayFac-as-a-Service

PayFac-as-a-Service is a new way for businesses to handle payments. It lets you skip building your own payment system. Instead, you use a ready-made platform for onboarding merchants, handling compliance, and processing transactions.

This platform connects your business with payment gateways like Stripe or PayPal. It makes it easy to process payments without the hassle of traditional payment facilitation.

Core components include:

- Automated merchant underwriting and onboarding

- Secure payment gateway integrations

- Real-time reporting tools

- Compliance management systems

Now, over 59% of businesses use embedded payment systems. And 67% of small and medium-sized businesses (SMBs) use cloud-based solutions for their financial needs. With PayFac-as-a-Service, you get top-notch security like encryption and tokenization. This ensures your business meets PCI-DSS standards.

Platforms like Stripe’s PayFac solution let you accept various payments without local banking needs. This is a big plus for businesses looking to expand globally.

Unlike old payment processors that take ages to set up, PayFac-as-a-Service gets you started in minutes. You can even customize payment interfaces with your brand’s look and feel. This way, your customers have a consistent experience.

PayFac vs Payment Processors

Choosing between a payment processor and a PayFac model changes how you onboard merchants and process transactions. Traditional payment processors make each merchant get their own account. This can take weeks and involves a lot of paperwork.

PayFacs, on the other hand, let businesses use a master account. This makes onboarding much faster, often in just hours. For example, Stripe’s PayFac model lets sub-merchants start in minutes. This avoids the long waits that traditional processors cause.

- Merchant onboarding: Payment processors demand individual merchant accounts, while PayFacs onboard businesses quickly through a shared account.

- Transaction processing: Processors charge variable fees based on interchange rates, whereas PayFacs often use flat-rate pricing for predictable costs.

- Compliance: PayFacs handle PCI DSS compliance for sub-merchants, whereas processors shift this responsibility to individual businesses.

- Risk management: PayFacs underwrite sub-merchants, reducing fraud exposure, while processors require you to manage risk independently.

For businesses that handle a lot of transactions, PayFacs like Stripe offer special pricing. They also settle transactions faster than traditional processors. With over 108.6 million card transactions daily in the U.S., picking the right model is key for smooth operations. PayFacs make things easier by handling compliance and onboarding for you. They’re great for platforms with many sellers or service providers.

PayFac vs PayFac-as-as-Service

Deciding between being a registered Payment Facilitator (PayFac) or using PayFac-as-a-Service depends on your business goals. A registered PayFac needs a big upfront investment and takes a long time to set up. On the other hand, PayFac-as-a-Service makes it easier with shared tasks.

| Aspect | Registered PayFac | PayFac-as-a-Service |

| Setup Time | 12–18 months | 4–6 weeks |

| Upfront Costs | $500,000+ for system development | No upfront fees (subscription-based) |

| Compliance Management | Full responsibility for PCI DSS, KYC, and AML | Handled by provider (e.g., Stripe, Adyen) |

| Payment Integration | Build custom systems from scratch | Pre-built payment integration tools |

| Risk Liability | Full liability for chargebacks and fraud | Risk shared or managed by provider |

| Annual Costs | $100,000+ for maintenance | Monthly fees (e.g., $2,000–$10,000/month) |

Registered PayFacs must invest in systems for compliance and handle all payment tech. PayFac-as-a-Service providers like PayPal Payouts or Chargebee simplify these tasks. Companies processing less than $100M a year might choose PFaaS to avoid huge costs. For instance, a SaaS company can start with payment features in weeks, not years, with ongoing costs instead of a big upfront payment.

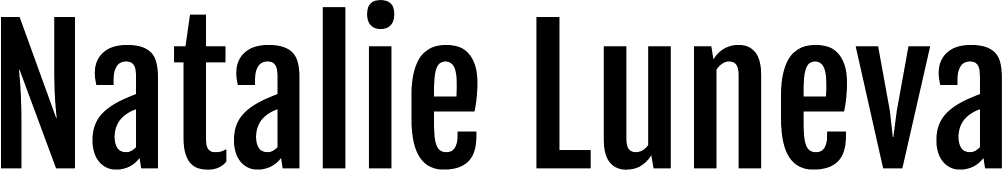

Benefits of Implementing PayFac-as-a-Service

Using PayFac-as-a-Service changes how businesses handle payments. It brings together efficiency, cost savings, and security. This helps you grow while easing your workload. Let’s look at the main benefits:

Simplified Payment Processing

No more dealing with many systems. PayFac-as-a-Service merges payment methods like credit cards and digital wallets into one place. It automates tasks, speeding up transactions and giving you real-time reports.

For example, you can process payments right away without getting bogged down by technical issues.

Faster Onboarding

Setting up merchant accounts used to take weeks. But with PayFac-as-a-Service, new sub-merchants can start in minutes. They fill out simple forms, and you get instant approval.

No more waiting. You can start taking payments right away.

Reduced Costs

Save money by cutting out fees from different vendors. PayFac providers handle costs like compliance and infrastructure. This lowers your overhead.

You also get to make money from transaction fees. This turns payment processing into a way to earn more without extra costs.

Improved Compliance

Keep your business safe with built-in fraud prevention tools. Providers take care of PCI compliance and fraud detection. They catch suspicious activity right away.

This protects your business and customers. You can focus on what you do best without worrying about legal issues.

Scalability

Scalability allows you to grow without the need to overhaul your entire setup. PayFac-as-a-Service manages more transactions and market growth on its own. It supports global scaling without requiring system rebuilds, processes millions of transactions without technical bottlenecks, and enables entry into new markets through pre-built regulatory frameworks.

Streamlined Merchant Management

Streamlined merchant management is made easy with centralized tools that automate processes. Automated onboarding with real-time compliance checks simplifies the setup process. You can monitor merchant activity through unified dashboards and generate reports instantly to track performance metrics. These tools can cut admin time by up to 40%, freeing up time to focus on your core business goals.

Enhanced Security

Enhanced security measures protect both you and your users. Real-time fraud detection systems, PCI-compliant encryption for sensitive data, and automated chargeback resolution processes safeguard your operations. These security measures help reduce fraud losses by up to 60%, in line with industry standards.

Flexibility

Flexibility enables you to customize payment solutions without facing technical hurdles. The service supports over 150 currencies and payment methods, offers white-label solutions for brand-aligned payment interfaces, and allows you to adjust fee structures to suit different business models. More than 70% of businesses leverage this flexibility to launch new financial services within 30 days.

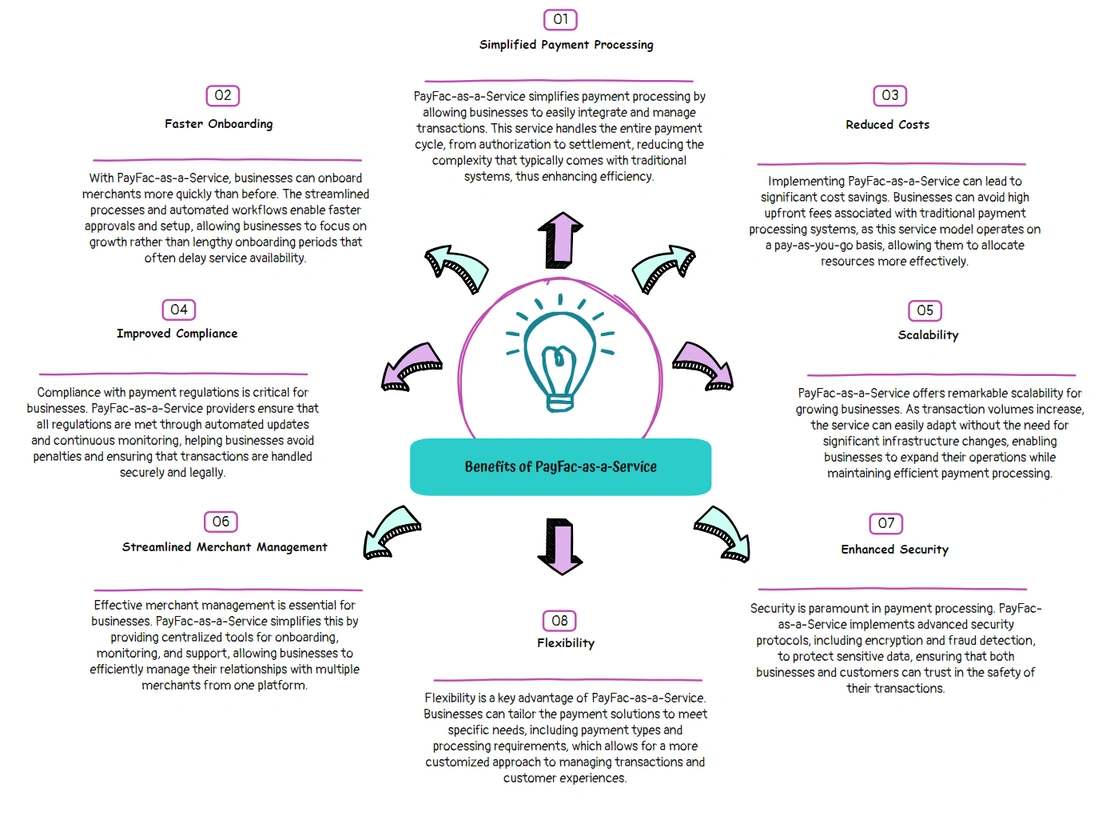

Challenges of the PayFac Model

Being a payment facilitator is tough. It can use up a lot of resources. You need to plan well for compliance, fraud, and money matters. Payfac services help with these problems while keeping your payment options flexible.

Compliance and Regulatory Risk

Rules are very strict. You must follow Visa and Mastercard’s rules, like the $1 million cap per sub-merchant. There are also $5,000 annual fees for each network. Payfac services can help with these costs, making your life easier.

Fraud Prevention

Fraud prevention is essential for monitoring suspicious activity in real-time across multiple sub-merchants. In high-risk areas like e-commerce, advanced AI fraud tools are necessary to stay ahead of potential threats. However, implementing these tools can be challenging for small teams.

Underwriting and Merchant Risk

Traditional PayFacs spend a lot of time and money checking merchants. This can cost up to $2.9 million. If you fail to check merchants well, you face chargebacks and penalties. Payfac services can help by using their own systems to quickly check merchants.

Funding and Cash Flow Management

Handling payments to sub-merchants and keeping reserves can be tricky. Traditional methods need a lot of money upfront. Payfac services offer flexible funding, making it easier to manage your money.

Complexity in Technical Integration

Setting up payment systems for thousands of sub-merchants can be costly and time-consuming, requiring APIs, reporting tools, and compliance frameworks. Businesses often experience delays due to the need for third-party audits for PCI DSS certification, compatibility issues between APIs and banking partners, and the challenge of implementing real-time fraud detection systems.

Customer Support and Merchant Management

Customer support and merchant management present significant challenges, particularly in handling disputes, refunds, and onboarding paperwork. Payment facilitators struggle with the constant need for 24/7 fraud monitoring, dealing with chargeback disputes that can cost between $25 and $100 per case, and ensuring compliance with Visa/Mastercard’s merchant underwriting standards.

Risk of High Chargeback Rates

High chargeback rates, especially those over 1% per month, can lead to fines and penalties. High-risk industries face full liability for sub-merchant losses, Visa/Mastercard’s $5,000 annual registration fees, and the potential for suspension due to repeated violations.

Reputation Management

Your PayFac’s reputation can be hurt by one bad merchant. It’s important to have strict merchant onboarding checks and ways to handle disputes. If you don’t prevent fraud well, you might face fines or lose trust with partners and customers.

Scalability and Growth Challenges

Going global presents scalability and growth challenges, particularly when dealing with different payment systems. You’ll need to navigate local rules that require separate licenses, such as the EU’s SEPA or China’s Alipay. The cost of adding local payment methods is significant, with Rapyd highlighting the complexity of offering over 900 methods. Additionally, handling different currencies while maintaining efficient transaction processing becomes a critical challenge.

Ongoing Maintenance and Upgrades

Ongoing maintenance and upgrades become increasingly costly over time. PCI compliance updates can range from $50k to $500k annually, while tools for managing merchants, including disputes and payouts, can exceed $500k. Security upgrades to combat fraud may cost over $800k each year. For small businesses, balancing the need for efficient transaction processing with the demands of new technology and compliance can be a significant financial burden.

How to Become a PayFac With PayFac-as-Service

To start a PayFac business with PayFac-as-a-Service, you need a clear plan. Follow these steps to make setup easier and avoid problems:

Choose a PayFac-as-a-Service Provider

First, pick a partner that fits your business goals. Look for companies like Stripe or SDK.finance. They offer flexible payment options and strong compliance tools. Important things to consider are:

- Expertise in rules like PCI DSS, AML, and state licensing

- Tools for custom payment gateways and easy merchant setup

- Clear fee plans

- Ability to handle transactions worldwide

Complete Provider Setup

Once you’ve chosen a provider, finish the partnership. This means:

Send over legal papers and business plans to get the green light. With Stripe, you can start in weeks, not months. Also, pay the $5,000 annual fee with card networks during this time.

Deploy Payment Solutions

Next, add payment gateways that fit your business. Use APIs to add payments to your current systems. This lets you offer:

- Custom checkout pages with your brand

- Support for many currencies

- Tools to catch fraud right away

Manage Compliance Obligations

Work with your provider to meet rules. You’ll share duties like:

- Checking merchants with OFAC/MATCH

- Getting PCI DSS Level 1 certification every year

- Monitoring AML and reporting to FinCEN

Platforms like Lightspeed and Shopify use Stripe’s tools to handle most rules. This lets you focus on your main work.

Set Merchant Onboarding Process

Use pre-built tools to automate onboarding. Platforms like Stripe’s API can approve merchants in a day. This is faster than old methods, helping 59% of businesses.

Key steps include:

- Use white-label forms to collect business details, bank account info, and tax documents

- Automate KYC/AML checks through integrated compliance tools

- Enable instant access to payment tools post-approval

Manage Risk and Fraud Prevention

Integrate fraud systems to catch suspicious activity fast. Tools like SDK.finance use machine learning to spot risky transactions. This can cut chargebacks by up to 40%.

Key controls include:

- Transaction velocity limits and geo-blocking

- Automated fraud scoring systems

- Chargeback alerts and dispute resolution dashboards

Launch and Offer Payment Solutions

Start offering payment services with the right pricing. Use tiered fees (0.5% to 1% per transaction) to make money. 73% of SMBs now add payments to their software, keeping customers.

Highlight features like:

- Multi-currency support for global transactions

- Split payouts for marketplaces

- Customizable payment branding

Ongoing Maintenance and Support

Regular checks keep you in line with security standards. Update fraud detection and underwriting criteria as needed. Focus on:

- Monthly merchant performance reports

- Quarterly compliance training for staff

- 24/7 fraud monitoring dashboards

Keep improving your payment strategies to grow revenue. Some platforms see 2–5x more value from embedded payments.

Ready to Become a PayFac? Let’s Talk!

Becoming a PayFac with PayFac-as-a-Service doesn’t have to be overwhelming. As a SaaS coach with expertise in payment solutions, I can guide you through the entire process, from understanding the model to overcoming challenges and ensuring compliance. With personalized advice and actionable strategies, I’ll help you build a successful PayFac operation that works for your business.

Contact me today to schedule a consultation and take the first step toward becoming a PayFac with ease!

Conclusion

Payfac as a service changes how we handle payments by cutting costs and speeding up market entry. You can start services in weeks, not months or years. This approach makes things easier and safer, faster than old methods.

Companies like Usio handle all the hard stuff, like keeping things legal and safe. They work with 350+ payment networks and watch everything 24/7. This lets you grow your business without worrying about payment details.

Using this service means you don’t have to spend a lot upfront. You make money from each transaction. You can also grow without spending a lot, thanks to customizable options and scalable systems.

Payfac as a service is a smart choice for getting into payment processing. It saves money, reduces risks, and gets you to market faster. With the help of experienced providers, you can grow your business while keeping it secure and efficient.

FAQs

What are the costs involved with using PayFac-as-a-Service?

The cost of using PayFac-as-a-Service can vary depending on the provider and the scale of your operations. Generally, costs are tied to transaction volumes, the number of sub-merchants, and the specific features or tools you choose to implement, such as fraud detection or reporting systems.

Can PayFac-as-a-Service integrate with my existing payment systems?

Yes, PayFac-as-a-Service can typically integrate with existing payment systems and platforms. Most providers offer APIs and tools that can be customized to fit your current infrastructure, streamlining payment processing and allowing for easy integration with your website or app.

What happens if a sub-merchant faces a chargeback?

PayFac-as-a-Service providers often have automated chargeback resolution processes in place. This means they can handle chargeback disputes on behalf of sub-merchants, helping to reduce administrative burden and mitigate the costs associated with chargebacks.

Can PayFac-as-a-Service handle recurring payments or subscriptions?

Yes, PayFac-as-a-Service can support recurring payments and subscription models. With built-in tools for subscription management, you can automate billing cycles, manage renewals, and handle payment collections seamlessly, which is ideal for businesses with subscription-based revenue models.