Did you know embedded payments can increase a software provider’s income? They turn payments into a new source of money. B2B payment transactions exceeded 15 billion in 2024, with digital payments now making up 85% of transactions.

Embedded payments are a game-changer. They add payment features right into apps or platforms. This makes it easy for users to pay without leaving their current screen. It’s all about making things simpler and better for the user.

Embedded payments are more than just a way to pay. They bring big benefits like happier customers and more sales. They also give businesses useful info on how people shop. Let’s dive into what embedded payments are, how they differ from integrated payments, and their many advantages for your business.

Key Takeaways

- Embedded payments integrate payment solutions directly into software platforms for seamless transactions.

- This approach can significantly enhance the customer experience, fostering loyalty and reducing turnover.

- Offering embedded payments allows platforms to unlock new revenue streams.

- Consumers prioritize convenience and speed, making embedded payments highly appealing.

- Embedded payments streamline compliance and reduce the complexities of managing third-party providers.

- The implementation of embedded payments can occur quickly and at a lower cost, making it accessible for businesses.

- Data from embedded payment systems can inform product development and marketing strategies.

What Are Embedded Payments

Embedded payments are payment options built right into software systems. This means businesses can offer a smooth payment experience right on their platforms. It’s all about making payments easy and seamless for users, without sending them to other websites.

For businesses, embedded payments provide for better customer service. It means no need for many vendors or complicated APIs. This makes everything simpler and faster, making customers happier.

Companies like Lightspeed Payments make it easy to add payment options with 24/7 support. This way, businesses can use data from payments to improve what they offer. The market for embedded finance is growing fast, expected to jump from $63.2 billion in 2023 to $291.3 billion by 2033.

Embedded payments also help keep customers coming back. They make checkout quick and easy. Businesses can use this data to create special loyalty programs, strengthening their bond with customers. Leaders like PayPal, Amazon, and Klarna show how embedded payments boost sales and cut down on cart abandonment.

| Feature | Embedded Payments | Traditional Payments |

| Checkout Experience | Seamless within software | Redirects to third-party sites |

| Vendors Required | Single-source integration | Multiple vendors necessary |

| Transaction Speed | Faster transactions | Generally slower |

| Customer Insights | Access to valuable data | Limited visibility |

| Customer Loyalty Programs | Easily created | More challenging to implement |

Embedded vs. Integrated Payments

Integrated payments link to external systems, often taking users to other sites. This can slow down transactions and make them less smooth.

Embedded payments, on the other hand, blend right into the platform. Companies like Uber and Lyft show how this works. They let users pay without leaving the app, making the process quicker and more user-friendly.

Embedded payments give businesses more control over payments and customer service. This can lead to stronger relationships with customers. Plus, businesses keep all the payment money, unlike integrated models that share it with others.

With embedded payments, software providers can add services like lending or insurance. This can increase revenue and let businesses set their own payment processing prices. Embedded payments make the payment process smoother, enhancing the user experience.

Setting up embedded payments can take from three weeks to three months. It requires a lot of work and knowledge of rules. But, the benefits can greatly improve your business’s payment system.

| Feature | Embedded Payments | Integrated Payments |

| Seamless User Experience | Integrated into the platform, reducing friction | Requires redirection to third-party portals |

| Revenue Retention | 100% retention of payment proceeds | Shares 30-50% with third-party providers |

| Customer Relationship Management | Closer relationships through full control | Limited relationship management capabilities |

| Implementation Time | 3 weeks to 3 months | Variable, depending on integration complexity |

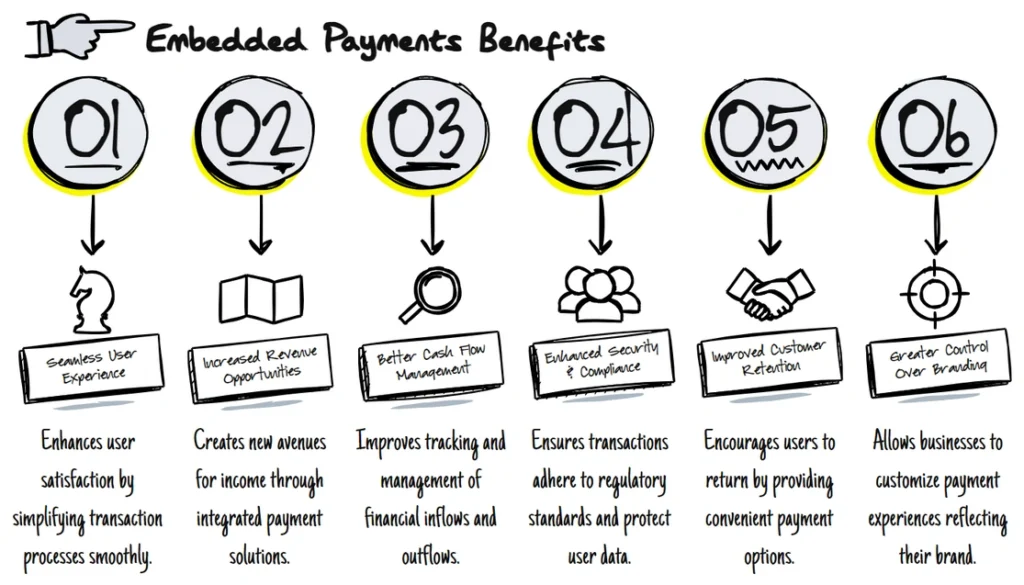

Benefits of Embedded Payments

Embedded payments bring many benefits to businesses. They improve user experience, help generate more revenue, and make financial management easier.

Seamless User Experience

Embedded payments make transactions smooth and quick. You don’t need to send users to other payment sites. This makes the buying process faster and more enjoyable.

Customers are happier and more likely to come back. It’s all about making the experience better for them.

Increased Revenue Opportunities

Embedded payments open up new ways to make money. You can charge fees, offer subscription services, and even add extra features like buy-now-pay-later. This creates different ways to earn income.

You also get valuable insights from customer data. This helps you offer services that fit their needs better, boosting sales. Plus, you can earn from processing fees and interchange revenue.

Better Cash Flow Management

Embedded payments also help with cash flow. They make payment processing faster, which improves your cash flow. You can manage different accounts and currencies easily.

This makes your operations more efficient. It also helps your finance team switch to electronic payments, making things smoother.

Enhanced Security & Compliance

Embedded payment technology makes transactions safer. It uses secure tokens and real-time fraud detection. This ensures businesses follow financial rules, keeping customer data safe.

Choosing compliant providers helps meet regulatory needs. It makes tracking transactions easier and protects customer info.

Improved Customer Retention

Easy payment processes keep customers coming back. Embedded payments make checkout simple, reducing cart abandonment. This leads to happier customers and more repeat business.

Offering smooth payments helps build strong customer relationships. It makes your brand more appealing and loyal.

Greater Control Over Branding

Embedded payments let you control your brand fully. You can design a payment process that matches your brand. This strengthens your brand and improves customer loyalty.

It makes your payment system a part of your unique identity. This enhances the user experience and keeps customers coming back.

How to Find the Right Embedded Payments Partner

Finding the right embedded payments partner is a big decision. You need to think about what your business needs are. Look at what each potential partner offers to make the best choice.

Define Your Business Needs

First, figure out what your business needs. Think about how many transactions you do, what your industry is, and what your customers expect. Knowing these things will help you find the right payment solutions for your goals.

Assess Integration Capabilities

Check how well potential partners can integrate with your systems. Look for APIs and SDKs that are easy to use. This will help your payments work smoothly without any problems.

Evaluate Security & Compliance

Evaluate the security and follow the law when choosing a partner. Make sure they have strong security and follow important laws like the Bank Secrecy Act. This keeps your customers’ information safe and protects their payments.

Analyze Pricing & Fees

Look closely at the costs of working with different partners. Understand their pricing and fees. This will help you know the total cost of using their services. Also, check if they offer flexible payment terms and quick payouts to help your business’s cash flow.

Consider Scalability & Support

Your partner should grow with your business. Scalability means they can handle more transactions and different payment methods as you expand. Good customer support is responsible for quick issue-solving and a great payment experience for everyone.

Look at Reputation & Reliability

Check the vendor reputation through customer and market feedback. Look at testimonials and case studies from other businesses. This helps you see if they’re reliable and can meet your needs.

Test the User Experience

Do user testing to see how your preferred solution works. Real users’ feedback is valuable for understanding usability and efficiency. You should know how customers feel about the payment process.

My Choice for Embedded Payments Partner: DepositFix

DepositFix is a top choice for embedded payments. It offers payment solutions for many industries like property, legal, and automotive. It makes customer interactions better and billing smoother, improving data accuracy.

This partner works well with many CRM and ERP systems. It fits with accounting, project management, and customer support tools. This means you can make workflows better and link payments to project steps, giving real-time financial updates.

DepositFix has helped over 1.3 million clients sell products and services. It has helped generate over $241 million in revenue. Its success in automated bookkeeping, recurring billing, and secure payments is clear.

Customers love DepositFix, saying it makes payments easy. They like features like dual pricing, custom invoices, and automation. Choosing DepositFix means improving your business operations.

Over 60% of financial and tech leaders see the value of embedded payments. As your business expands, DepositFix can give you the edge you need, especially in SaaS.

Get Expert Advice on Boosting Revenue with Embedded Payments

As a SaaS coach specialized in embedded payments, I can help you unlock the full potential of payment integration for your business. Whether you’re looking to streamline your checkout process, enhance customer experience, or boost your revenue, I can provide tailored strategies and insights.

Contact me today and get expert advice on how to increase your revenue with embedded payments!

Conclusion

Embedded payments are changing how businesses handle transactions. They make payments easier and improve the user experience. This leads to smoother operations and higher revenues.

Embedded payments help you keep customers coming back and stay ahead in a fast-changing market.

But, there are downsides to consider. Hidden fees, security risks, and the chance of monopolies are concerns. Build trust, be open about fees, and keep the data safe.

Businesses need to watch out for data privacy and fraud. This ensures a smooth payment process for everyone.

The real value of embedded payments is the edge they give businesses. With the right partner, your business can grow and keep customers loyal.

FAQs

How do embedded payments differ from traditional payment gateways?

Embedded payments are integrated directly into a platform or software, allowing users to complete transactions without being redirected to a third-party processor. Traditional payment gateways, on the other hand, often require customers to leave the platform to complete their purchase, adding friction to the checkout process.

Can embedded payments support multiple payment methods?

Yes, most embedded payment solutions support credit/debit cards, ACH transfers, digital wallets (Apple Pay, Google Pay), and even Buy Now, Pay Later (BNPL) options, depending on the provider.

Are embedded payments suitable for small businesses?

Yes, small businesses can benefit from embedded payments, as they streamline transactions, improve cash flow, and reduce administrative overhead. Many providers offer scalable solutions tailored to businesses of all sizes.

What industries benefit the most from embedded payments?

SaaS companies, marketplaces, e-commerce platforms, fintech services, and on-demand service providers (like ride-sharing or food delivery apps) benefit the most from embedded payments due to their need for seamless transactions.

Can embedded payments handle international transactions?

Many embedded payment providers offer multi-currency support, cross-border payments, and compliance with international regulations, making them ideal for global businesses. However, fees and processing times may vary based on the provider.

How do I transition from a traditional payment gateway to embedded payments?

The transition involves selecting a provider that integrates with your existing system, updating your checkout flow, ensuring compliance with security regulations, and training your team on the new process. Most providers offer migration support to make the switch seamless.