Construction cash flow refers to the movement of money in and out of a construction business over the course of a project. Unlike regular cash flow in other industries, it’s highly irregular because payments often arrive in large installments tied to project milestones, while expenses like payroll, materials, equipment, and subcontractors need to be covered continuously. This mismatch can create serious financial strain, even on projects that are technically profitable.

Key Takeaways

- Construction cash flow is the movement of money in and out of your business.

- Positive cash flow ensures you can pay employees, cover suppliers, and handle unexpected expenses without disruption.

- Monitoring income streams and expenses separately helps prevent financial strain even on profitable projects.

- Tools like DepositFix and expert coaching from Natalie Luneva can streamline payments and improve operational efficiency.

- Regular cash flow forecasting and proactive management help in sustaining growth and maintaining financial stability.

What Is a Construction Cash Flow

A construction cash flow is the financial lifeline of any construction project, representing the timing and movement of money coming in and going out of the business. Unlike many other industries where revenue and expenses follow a predictable cycle, construction cash flow is often uneven and heavily dependent on project contracts, billing schedules, and client payments.

For example, a contractor may need to pay upfront for labor, equipment rentals, permits, and materials long before receiving payment from the project owner. At the same time, progress payments or retainage clauses can delay incoming funds, creating a gap between expenses and revenue.

This makes managing construction cash flow more complex than standard business cash flow because it’s not just about profitability, it’s about having enough liquid cash available at the right time to keep the project moving. When managed effectively, positive cash flow ensures that contractors can pay employees, cover suppliers, and handle unexpected costs without disruption.

However, poor cash flow management can stall projects, damage relationships with subcontractors, and even put the entire business at risk, regardless of how profitable the project may look on paper.

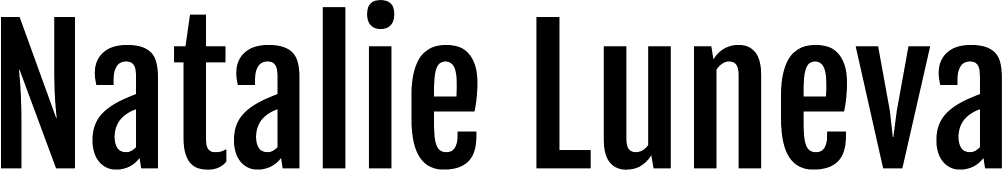

Construction Company Income Streams

A construction company generates revenue from several sources, each of which can vary depending on the project type, client, and contract structure. The primary income comes from client contracts, but other revenue sources can supplement cash flow and stabilize finances. Understanding all these streams helps contractors anticipate cash inflows and plan for periods when payments might be delayed. Common construction income streams include:

- Progress payments tied to project milestones

- Fixed-price contracts

- Cost-plus contracts

- Time-and-materials contracts

- Change orders for additional work

- Equipment rentals or subcontracted services

- Maintenance or service contracts

- Consulting or advisory services

Construction Company Expenses

Construction expenses are numerous and often occur before the company receives payment. Expenses can be divided into direct project costs and indirect overhead costs, both of which must be monitored to maintain a healthy cash flow. Key expenses include:

- Labor costs, including wages, benefits, and payroll taxes

- Subcontractor payments

- Materials and supplies

- Equipment purchases or rentals

- Permits and licensing fees

- Insurance and bonding

- Utilities for construction sites

- Administrative and office overhead

- Marketing and business development costs

- Unexpected costs such as project delays or accidents

Why Is the Cash Flow in Construction Important

Cash flow is the heartbeat of any construction business, and managing it effectively can make the difference between smooth project execution and financial stress. Unlike other industries, construction projects often involve large upfront costs for labor, materials, and equipment, while payments from clients may be delayed until project milestones are completed. This timing mismatch means even profitable projects can experience cash shortages if inflows and outflows aren’t carefully managed.

Positive cash flow ensures that a construction company can pay employees and subcontractors on time, purchase materials without delay, and handle unexpected expenses such as equipment breakdowns or schedule changes. It also allows businesses to take on multiple projects simultaneously without risking financial instability.

On the other hand, poor cash flow can stall projects, strain relationships with clients and suppliers, and even jeopardize the long-term survival of the company. Essentially, monitoring and maintaining healthy cash flow is not just about keeping the business running day-to-day, it’s about sustaining growth, building trust with stakeholders, and maintaining a competitive edge in the construction industry.

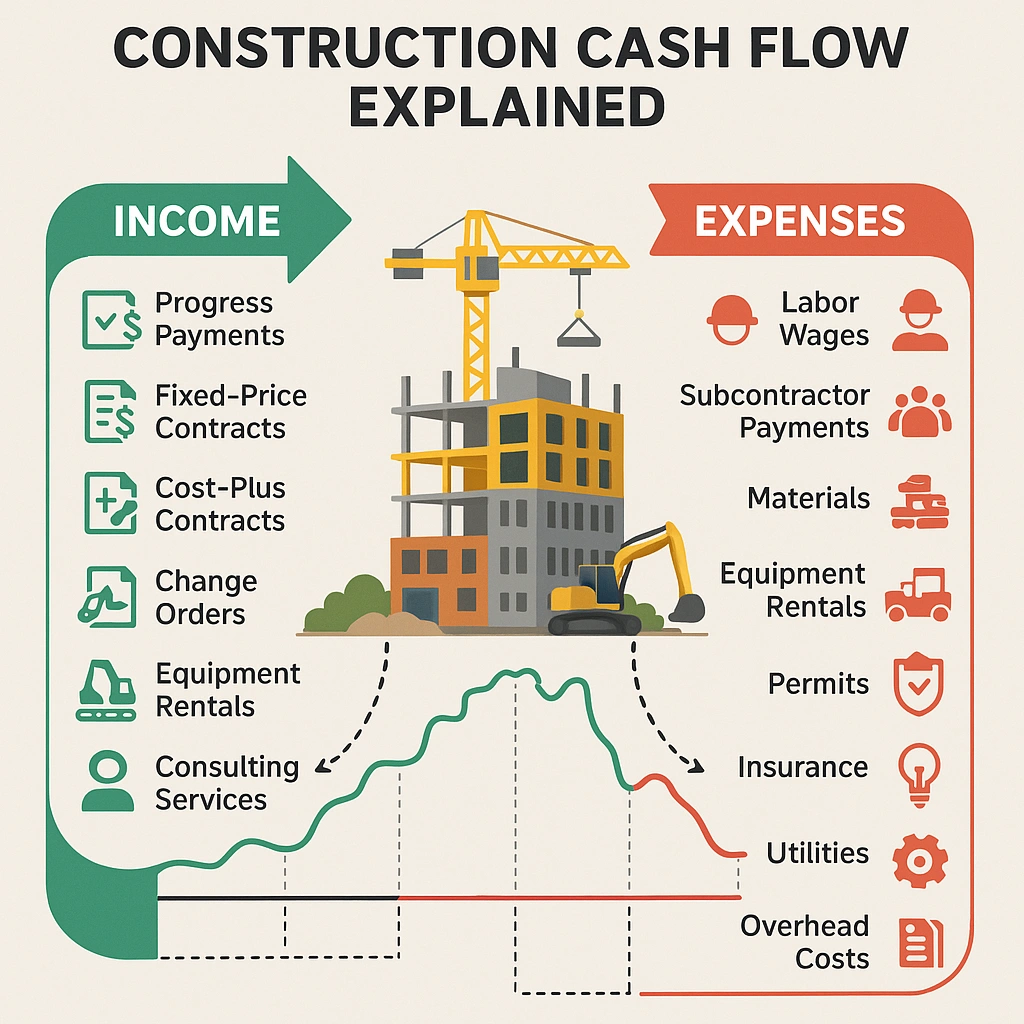

Positive Cash Flow vs Negative Cash Flow

In construction, cash flow can be either positive or negative, and understanding the difference helps in maintaining financial stability.

Positive cash flow occurs when a company’s incoming payments exceed its outgoing expenses, allowing it to cover operational costs, invest in new projects, and handle unexpected expenses with ease.

Negative cash flow, on the other hand, happens when expenses outpace income, forcing the company to rely on loans, delay payments, or cut back on critical resources. While negative cash flow doesn’t automatically mean a project is unprofitable, it signals potential financial strain that can disrupt operations if not addressed promptly.

Cash Flow vs Net Profit

Many contractors confuse cash flow with net profit, but they are not the same. Net profit reflects the overall profitability of a project after all expenses are deducted from revenue, regardless of when money actually changes hands.

Cash flow, however, focuses on the timing of those cash inflows and outflows. A project can be profitable on paper yet experience cash shortages if payments are delayed, highlighting the importance of monitoring cash flow separately from net profit to ensure day-to-day financial health.

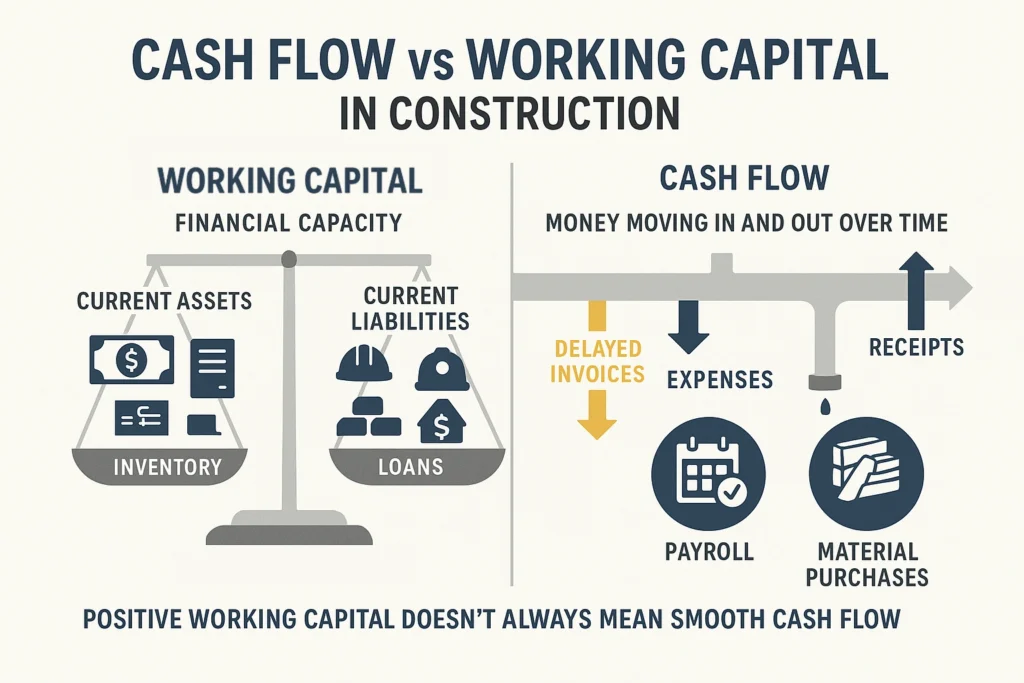

Cash Flow vs Working Capital

Working capital represents the difference between a company’s current assets and current liabilities, essentially showing the resources available to cover short-term obligations. While working capital gives a snapshot of financial capacity, cash flow tracks the actual movement of money over time.

Positive working capital doesn’t automatically guarantee smooth cash flow, as funds may be tied up in unpaid invoices or inventory. Understanding both concepts together helps construction companies manage liquidity effectively, ensuring that they have enough cash on hand to pay for labor, materials, and other operational needs without disruption.

How to Calculate Construction Cash Flow

Calculating cash flow helps construction companies to understand how money moves through their business and to plan for upcoming expenses and revenue. Unlike simply looking at profits, cash flow analysis focuses on the timing of payments and receipts, helping contractors anticipate shortages, avoid delays, and make informed decisions.

There are several methods to calculate cash flow, ranging from simple formulas to more detailed approaches that account for operational, investing, and financing activities.

Basic Cash Flow Formula

The basic cash flow formula provides a simple way to track the net cash generated or used over a period of time. It is calculated by subtracting total cash outflows from total cash inflows. This method gives a quick snapshot of whether a construction business is generating more money than it is spending, making it a useful starting point for small contractors or for reviewing overall financial health on a high level.

The basic cash flow formula calculates the net cash generated or used over a period:

Cash Flow = Total Cash Inflows − Total Cash Outflows

Operating Cash Flow Formula

Operating cash flow focuses specifically on the cash generated or used by core business activities, such as project work, labor, and materials. It can be calculated by taking net income, adding back non-cash expenses like depreciation, and adjusting for changes in working capital. This formula provides insight into how efficiently the company’s day-to-day operations generate cash.

Operating cash flow focuses on cash generated from core business operations:

Operating Cash Flow = Net Income + Non-Cash Expenses (e.g., Depreciation) ± Changes in Working Capital

Investing Cash Flow Formula

Investing cash flow tracks the money spent on or received from long-term investments, such as purchasing or selling equipment, property, or other assets. It is calculated by subtracting cash outflows for asset purchases from cash inflows from asset sales. Monitoring investing cash flow helps construction companies plan for major expenditures, ensuring that investments in tools or equipment do not negatively impact operational liquidity.

Investing cash flow tracks cash used for or received from investments in long-term assets:

Investing Cash Flow = Cash Inflows from Asset Sales − Cash Outflows for Asset Purchases

Financing Cash Flow Formula

Financing cash flow measures the cash received from or paid to external sources of funding, including loans, lines of credit, and equity contributions. It is calculated by adding cash inflows from borrowings or investor contributions and subtracting cash outflows from loan repayments, dividends, or other financing costs. This formula helps contractors understand how financing activities affect overall cash availability, making it easier to balance debt obligations with operational needs.

Financing cash flow measures cash movement from borrowing or repaying funds:

Financing Cash Flow = Cash Inflows from Loans or Investments − Cash Outflows for Repayments or Dividends

Common Cash Flow Issues for Construction Companies

Managing cash flow in construction isn’t just about tracking profits, it’s about ensuring that money is available when and where it’s needed. Several common issues can disrupt the flow of funds, putting projects and business operations at risk.

Delayed Client Payments

One of the biggest cash flow challenges in construction is waiting for client payments. Many projects operate on milestone-based billing, meaning contractors may spend weeks or months covering labor and materials before receiving any revenue. Delays in payments can create a cash crunch, forcing companies to borrow funds or delay other obligations.

Poor Project Cost Estimation

Underestimating project costs can quickly turn a profitable-looking job into a financial headache. If materials, labor, or equipment are underestimated, contractors may spend more than anticipated, leading to negative cash flow despite earning revenue. Accurate cost estimation is prevents budget shortfalls.

High Overhead Costs

Overhead expenses, such as office rent, utilities, administrative staff salaries, insurance, and software subscriptions, can quietly drain cash if not managed carefully. Even when projects are running smoothly, high overhead can reduce the money available for daily operations and project needs.

Retainage and Payment Holds

Many contracts include retainage clauses, where a portion of the payment is withheld until project completion. While this protects clients, it can create significant cash flow gaps for contractors who must pay workers and suppliers in full before receiving the retained funds.

Unforeseen Project Delays

Weather, permitting issues, or labor shortages can delay projects, pushing back revenue while ongoing expenses continue. These disruptions can quickly strain cash reserves and impact the company’s ability to start new projects on time.

Equipment and Material Cost Overruns

Unexpected spikes in material prices or urgent equipment rentals can add significant unplanned costs. Without careful tracking, these overruns can eat into cash flow and force companies to divert funds from other projects.

Inefficient Invoicing Processes

Slow or inconsistent invoicing can delay payments, even on completed work. If invoices aren’t sent promptly or contain errors, clients may take longer to pay, exacerbating cash flow problems. Streamlined invoicing keeps money moving in.

Excessive Reliance on Subcontractors

Relying heavily on subcontractors can create timing issues with payments. If subcontractors are paid upfront or on tight schedules, while the client payment is delayed, the contractor may face a cash crunch, even if the project is profitable.

Seasonal Fluctuations in Work

Construction work can be seasonal, with slower periods during bad weather or off-peak months. Without careful planning, companies may struggle to cover expenses during these slow periods, causing temporary negative cash flow.

Lack of Cash Flow Forecasting

Many construction companies fail to forecast cash flow accurately, relying on assumptions rather than real data. Without a clear picture of upcoming inflows and outflows, it’s easy to run into shortages, miss payments, or lose opportunities to invest in new projects.

How to Improve Cash Flow for Your Construction Company

Improving cash flow keeps construction projects on schedule, pays workers and suppliers on time, and maintains financial stability. When contractors proactively manage both income and expenses, they can avoid cash shortages and create a smoother, more predictable financial cycle. Here are some effective strategies to boost cash flow for your construction business:

Accelerate Client Payments

Encourage faster payments and clear payment terms, offer incentives for early payment, and invoice promptly after completing milestones.

Implement Accurate Cost Estimation

Use detailed project budgets and track costs closely to avoid underestimating labor, materials, and equipment expenses.

Monitor and Reduce Overhead Costs

Regularly review overhead expenses and identify areas where costs can be cut or optimized without compromising operations.

Manage Retainage Effectively

Negotiate retainage terms when possible and plan cash reserves to cover periods when payments are withheld.

Plan for Project Delays

Include contingency funds in budgets and maintain a cash buffer to handle unforeseen delays without disrupting operations.

Control Equipment and Material Spending

Track material usage, negotiate better rates with suppliers, and avoid last-minute equipment rentals that inflate costs.

Streamline Invoicing Processes

Automate invoicing, ensure accuracy, and follow up promptly on unpaid invoices to reduce payment delays.

Optimize Subcontractor Payments

Align subcontractor payment schedules with incoming project payments to avoid cash flow gaps.

Forecast Cash Flow Regularly

Create short- and long-term cash flow projections to anticipate shortages and make informed financial decisions.

Diversify Income Streams

Take on different types of projects, maintenance contracts, or consulting work to stabilize revenue and reduce reliance on a single source of income.

Improve Construction Cash Flow with Natalie Luneva and DepositFix

Managing cash flow effectively contributes to the success and growth of your construction business. With the expert business coaching from Natalie Luneva and the automated payment solutions of DepositFix, you can streamline your operations, reduce administrative burdens, and ensure timely payments.

Natalie Luneva: Expert Business Coaching for Contractors

Natalie Luneva specializes in helping construction businesses optimize their operations and scale effectively. Her coaching services focus on:

- Milestone Payment Strategies: Implementing milestone-based billing to align cash flow with project progress.

- Financial Key Performance Indicators (KPIs): Tracking metrics like backlog, win rate, and days sales outstanding (DSO) to monitor business health.

- Operational Efficiency: Streamlining processes to improve profitability and reduce delays.

- Team Development: Building a stable core team to support business growth.

DepositFix: Automate Invoicing and Payments

DepositFix offers a comprehensive billing solution designed to enhance cash flow management for construction companies. Key features include:

- Automated Invoicing & Payment Collection: Generate invoices instantly or on a recurring basis, reducing manual work and errors.

- Secure Payment Gateways: Integrate with reliable processors like Stripe and PayPal to ensure smooth transactions.

- Customizable Branding & Portal Design: Create a consistent, branded billing solution that reflects your business.

- Enhanced Cash Flow Consistency: Automated reminders and recurring billing help reduce late payments, ensuring a steady cash flow.

Combined Benefits: Coaching + Automation

With Natalie Luneva’s coaching and DepositFix’s automation tools, your construction business can achieve:

| Benefit | Natalie Luneva | DepositFix |

| Improved cash flow | ✅ | ✅ |

| Streamlined invoicing | ✅ | |

| Timely payments | ✅ | |

| Operational efficiency | ✅ | ✅ |

| Financial oversight | ✅ |

Partnering with Natalie Luneva and DepositFix provides a holistic approach to managing and improving your construction business’s cash flow. With expert guidance and automated tools, you can focus on growth while ensuring financial stability.

Conclusion

Effectively managing construction cash flow helps in keeping projects on track, paying employees and suppliers on time, and sustaining long-term business growth. Implementing strategies such as accelerating client payments, accurate cost estimation, streamlined invoicing, and careful forecasting can transform cash flow from a challenge into a competitive advantage.

Partnering with experts like Natalie Luneva for business coaching and leveraging automated solutions like DepositFix further strengthens your cash flow management. Together, they provide actionable guidance, efficient payment collection, and operational oversight that help contractors maintain liquidity, reduce stress, and focus on growing their business. Ultimately, mastering cash flow is not just about surviving financially—it’s about creating a foundation for profitable, sustainable, and scalable construction operations.

FAQs

What is the best way to track cash flow for multiple construction projects?

Using project management or accounting software that allows you to track income and expenses per project is ideal. Tools like DepositFix can help monitor cash flow across multiple projects simultaneously.

How often should a construction company review its cash flow?

Ideally, cash flow should be reviewed weekly or at least monthly. Frequent monitoring allows contractors to identify potential shortfalls early and take corrective actions before issues escalate.

Can a profitable project still create cash flow problems?

Yes. A project can be profitable on paper but still strain cash flow if payments are delayed, expenses are front-loaded, or retainage holds back significant revenue.

How can subcontractor contracts affect cash flow?

Subcontractor payment terms that require upfront or rapid payments can create cash gaps if client payments are delayed. Aligning subcontractor payments with project revenue helps maintain liquidity.

How does retainage impact a company’s working capital?

Retainage reduces immediate cash availability because a portion of the payment is withheld until project completion. This can temporarily strain working capital even if the project is profitable.

Can financing options help with short-term cash flow issues?

Yes. Lines of credit, short-term loans, or invoice factoring can bridge temporary cash flow gaps, but they should be used carefully to avoid excessive debt.

How can a construction company forecast future cash flow accurately?

Forecasting involves analyzing historical project data, tracking pending invoices, anticipating upcoming expenses, and accounting for seasonal trends. Using software that integrates project management and accounting makes forecasts more precise.