You need a clear path from hands-on skill to lasting profit. This guide lays out a practical plan that maps market realities into stepwise actions you can use today.

The U.S. construction and contractor industry was valued at $1.8 trillion in 2022, with expectations of continued growth through 2026.

Natalie Luneva’s contractor-focused coaching helps tighten strategy, leadership cadence, and accountability so growth stays controlled. DepositFix speeds cash flow with online payments, automated invoicing, and CRM-integrated follow-ups, reducing admin and invoice lag.

Expect practical coverage from legal setup and licensing to job-costing habits, supplier relationships, and local marketing that builds steady leads. The goal is simple: align operations, people, and tech for measurable success.

Key Takeaways

- Convert trade expertise into a repeatable, local company plan.

- Anchor growth in niche focus, a plan, and working capital.

- Use automation and payments to protect margins and cash flow.

- Align leadership rhythm and processes for scalable results.

- Leverage coaching and tools like DepositFix for faster invoicing and follow-up.

Set your foundation: niche, market demand, and a plan you can execute

Start with a clear niche and realistic financial projections that match local demand. Pick a narrow specialty and identify nearby customer segments that buy often. This focus sharpens pricing, marketing, and operations from day one.

Pick a profitable niche and validate demand

Analyze neighborhood trends, competitor gaps, and seasonality. Prioritize services with repeat work and the fastest path to profit. Use quotes and local vendor calls to confirm assumptions.

Build a practical business plan

Draft a concise business plan that ties goals, services, pricing, and staffing to simple financial projections. Include market analysis, organization, sales strategy, and funding needs.

Secure financing and working capital

Match financing to asset life: equipment financing for trucks and tools, short-term lines for operational runway. Plan a cash buffer; many startups fail from underestimating working capital.

- Map a 90-day execution checklist: milestones, supplier setup, and outreach.

- Document roles so hiring and subcontracting track back to goals.

| Item | Typical Range (USD) | Suggested Funding | Notes |

| Equipment | $5,000–$50,000 | Equipment loan | Match term to useful life |

| Vehicle | $20,000–$40,000 | Lease or loan | Include branding and maintenance |

| Licenses & Permits | $500–$5,000 | Startup funds | Check local requirements |

| Working Capital | $10,000–$30,000 | Line of credit | Protect against slow pay |

How to grow your trade business with a proven step-by-step approach

This approach starts with firm legal setup and simple operations that scale. Choose an entity like an LLC or corporation, register your name, get required licenses, and buy proper insurance. Missteps here create risk that blocks capacity and profits.

Legal setup, licensing, insurance, and compliance essentials

Secure state and local permits, register for taxes, and classify staff correctly. Don’t run without coverage or valid credentials; audits and claims are costly and slow momentum. Have clear payroll and contractor policies to avoid misclassification.

Standardize operations: scheduling, dispatch, SOPs, and supplier relationships

Create written procedures for scheduling, dispatch, and job closeout. Use field service software and DepositFix for payments and mobile updates. Lock supplier terms and keep backups so materials don’t stall work.

Measure what matters: margins, job costing, and forecasting

Track labor hours, materials, and overhead on every job. Use weekly reports for margin management and forecasting capacity. Good data guides hiring and pricing decisions.

Incremental growth goals: capacity planning and quality control

Set small targets like weekly install capacity and first-time fix rates. Review them in management meetings and update SOPs when callbacks appear. This preserves quality as demand is building.

- Pick the right legal structure and insurance before scaling operations.

- Standardize processes for scheduling, photo documentation, and closeout.

- Implement job costing and use forecasting to avoid capacity gaps.

Optimize cash flow and pricing so growth doesn’t stall

Cash timing and clear pricing keep projects moving and margins intact. Fast quotes win bids without resorting to deep discounts. Standardize estimates with scopes, exclusions, and options so you can reply within hours instead of days.

Streamline quotes to win work faster without harmful discounting

Build templates that separate labor and materials. Offer clear options and deposits. Use DepositFix for instant payment links at quote acceptance, shortening the path from estimate to deposit.

Price for profit: understand labor, materials, and gross margin benchmarks

Price with intent and list labor, materials, overhead, and target gross margin. Validate figures against job-cost data and industry benchmarks. Natalie Luneva’s pricing coaching can sharpen margins and decision rules.

Invoice promptly, reduce aged receivables, and forecast cash needs

Invoice at milestones or completion and enable online payments. Automate reminders and track aged receivables by customer. Forecast weekly inflows and outflows so payroll, taxes, and purchases are timed without borrowing.

- Use deposits and progress billing to align cash with phases.

- Monitor costs and expenses, especially material volatility and overtime.

- Enforce collections policies to stop slow pay from compounding into crises.

| Action | Tool/Metric | Expected Result | Timing |

| Standardized estimates | Template with exclusions | Faster approvals; fewer discounts | Hours |

| Deposit & progress billing | Payment links (DepositFix) | Improved cash; lower risk on large jobs | At contract / milestones |

| Invoice automation | Automated invoicing & reminders | Lower days sales outstanding | Immediate |

| Weekly forecasting | Cash inflow/outflow model | Smarter purchase and payroll timing | Weekly |

Market smarter: local SEO, reviews, and predictable lead generation

Predictable leads start with clear marketing systems and measurement you can trust each week. Set up a basic stack that links website, Google Business Profile, ad funnels, and DepositFix payment pages so prospects convert fast and payments follow naturally.

Build a conversion-ready website and local footprint

Create pages for core services, service areas, proof (photos and reviews), and a click-to-call button that works on phones. Optimize title tags and meta descriptions for local searches. Fast loading and simple forms lift conversion rates.

Systematize reputation and review capture

Ask customers for reviews by text or email and include a single link. Respond quickly and politely to all feedback. Regular review wins improve rankings and reassure new customers.

Run targeted ads and partnerships to smooth seasonality

Match ad spend to your highest-margin services and send clicks to focused landing pages. Build referral agreements with realtors, HOAs, and property managers for steady leads during slow months.

- Track cost per lead and booked-job rate by channel.

- Use content and maintenance offers to re-engage past customers and route accepted work straight into scheduling and payment pages.

- Measure weekly so a coach can adjust efforts and hand off clean leads into DepositFix checkout flows.

| Channel | Primary Metric | Action |

| Organic / Local SEO | Leads per month | Optimize GBP and landing pages |

| Paid Search / Social | Cost per lead | Target top-margin services |

| Referrals | Booked rate | Formalize partner agreements |

Scale operations: team, technology, and SBA-supported expansion paths

Scaling operations means matching hires, tools, and cash so field work stays reliable as volume rises. Sequence recruiting, onboarding, and training so new technicians meet quality standards quickly. This prevents spikes in callbacks and keeps margins healthy.

Recruit and train technicians, then layer in field service management tools

Recruit with clear job specs and skills checklists. Use short shadowing periods, scorecards, and staged certifications for fast ramp-up.

Layer in field service management software and DepositFix payment flows to unify scheduling, dispatch, and payments. That reduces admin time and insures deposit collection at booking.

Adopt CRM and project management for visibility across jobs and teams

Install a CRM tied to project management so you see job status, invoices, and crew capacity in one place. Use workload and overtime data to guide hiring or subcontracting decisions.

Promote top performers into leadership roles and give them scorecards and training. A growing company needs local leaders who can protect response times and quality.

Explore SBA-backed avenues: new locations, federal contracting, and exporting where applicable

Evaluate SBA-supported growth opportunities like new locations, federal contracting, exporting, or acquisitions. Update your financial model and marketing plan before expansion and confirm compliance in new areas.

- Sequence hiring, onboarding, and training for steady capacity gains.

- Unify FSM, CRM, and project tools for job visibility and smoother management.

- Use SBA paths or acquisitions to diversify revenue with disciplined integration plans.

| Area | Core Action | Expected Impact |

| Hiring & Training | Staged onboarding and scorecards | Faster competency; fewer callbacks |

| Technology | FSM + CRM + DepositFix | Clear schedules; faster deposits |

| Expansion | SBA programs, federal bids, acquisitions | Diversified revenue; stabilized seasonality |

Leverage Natalie Luneva’s growth coaching for contractors

Practical coaching helps contractors sharpen offers and lead teams with clarity. Natalie Luneva focuses on positioning, a tight service mix, and a leadership cadence that keeps priorities visible.

Clarify strategy, positioning, and service mix

Work with Natalie to simplify offers so they sell and deliver well. That makes proposals easier, margins clearer, and customer choice obvious.

Build a leadership cadence: hiring, performance, and culture

Install weekly scorecards, KPIs, and one-on-ones that shift emphasis from activity to outcomes. Create a hiring plan that sequences foremen, technicians, and coordinators.

Implement scalable processes, funnels, and accountability

Map funnels from lead to booked job and standardize quoting, dispatch, closeout, and follow-up. Accountability rhythms keep campaigns and field teams aligned.

Identify opportunities: upsells, geographies, partnerships, acquisitions

Partner with Natalie to surface growth opportunities like maintenance plans, expansion into nearby ZIP codes, strategic alliances, or targeted acquisitions that match capacity.

- Translate coaching into a 90-day plan with owners and a visible scoreboard.

- Install performance systems that coach employees toward measurable results.

- Standardize processes so quality holds as volume rises.

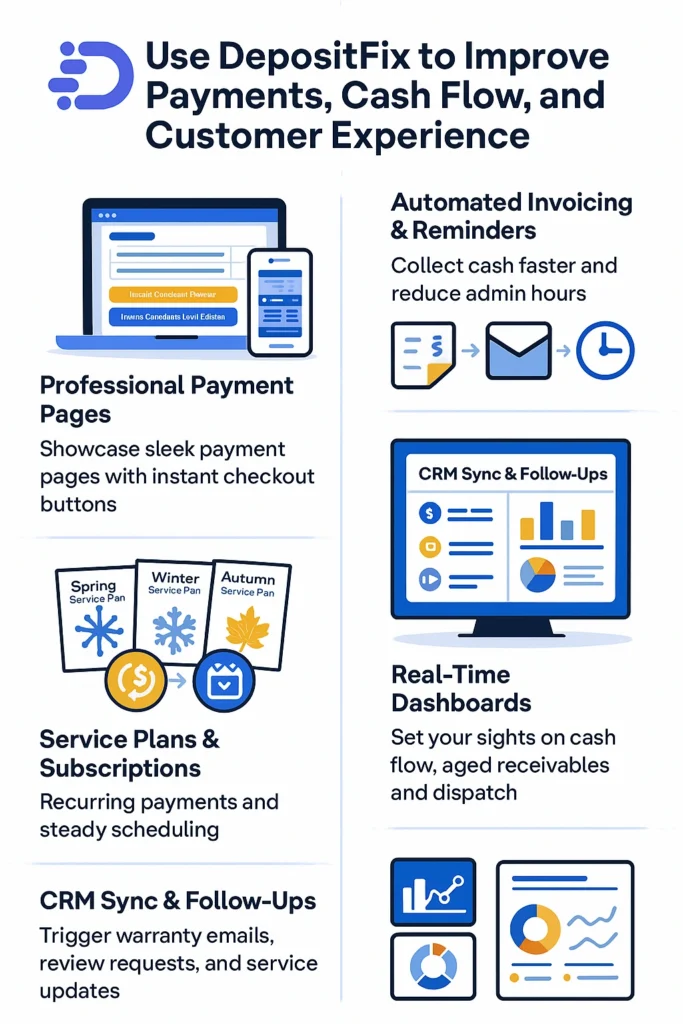

Use DepositFix to improve payments, cash flow, and customer experience

Fast, reliable payments cut admin time and keep crews moving on billable work. DepositFix helps you accept online payments and automate invoicing so cash arrives sooner and manual follow-up drops dramatically.

Build polished payment pages and instant checkout that let customers pay deposits or final balances from any device the moment a quote is approved. That immediacy reduces friction and improves the overall service experience.

Accept online payments and automate invoicing to speed up cash collection

Automated invoicing and reminder sequences shorten collection windows and free admin staff. Field service teams reclaim 15–20 hours per week when payments and invoices run without manual work.

Create payment pages, subscriptions, and service plans for recurring revenue

Package subscriptions and seasonal service plans to stabilize cash flow and improve scheduling. Recurring payments raise lifetime value and make forecasting simpler.

Integrate payments with your CRM and automate follow-ups

Sync DepositFix with your CRM so payments trigger service updates, warranty emails, and review requests. This tight integration standardizes processes across operations and keeps customer touchpoints consistent.

- Professional payment pages: Instant checkout for deposits and balances.

- Automated reminders: Fewer aged receivables, steadier cash.

- Service plans: Recurring revenue and better scheduling.

- CRM sync: Auto follow-ups and post-job communications.

- Real-time dashboards: Prioritize dispatch and materials buys with payment visibility.

Contact Natalie Luneva and see how you can grow your trade business with the tools that DepositFix offers!

Conclusion

Close the loop and convert plans and tools into repeatable work that pays.

Use this guide as a checklist: finalize a clear business plan, standardize quotes and job costing, and add one automation that saves time now.

Revisit the plan each quarter and tighten estimates with real job data. Focus on leading indicators like response time, first-time fix rate, and gross margin.

Partner with Natalie Luneva to sharpen strategy and leadership cadence, and implement DepositFix to speed quotes-to-cash, streamline payments, and improve customer experience.

Protect cash, measure processes, and keep quality central. With steady adaptation and the right tools, you can build a successful trade business that earns customers’ trust and lasts.

FAQs

What is the difference between a trade business and a general contracting business?

A trade business focuses on a specific skill or service—like plumbing, electrical work, or HVAC—whereas a general contractor manages multiple trades and oversees complete projects. Trade businesses often specialize in one niche, which can make pricing, marketing, and operations more streamlined.

How long does it usually take to grow a trade business to a stable income?

The timeline varies, but most trade businesses take 12–24 months to reach consistent profitability if they start with a solid plan, working capital, and steady lead generation. Factors like market demand, competition, and operational efficiency can shorten or lengthen this period.

Should I offer discounts for early payment?

Yes, if the discount is small enough to protect margins (for example, 2% off if paid within 10 days). This can accelerate cash flow, but make sure the savings are worth the reduced income.

Is flat-rate pricing better than hourly pricing for trades?

Flat-rate pricing often works better for common, repeatable jobs because it’s easier for customers to understand and can reward efficiency. Hourly pricing is best for unpredictable or complex jobs.