To improve cash flow in your trade business, you need to shorten the time between completing a job and receiving payment, while carefully managing outgoing expenses. That means sending invoices immediately, setting firm payment terms, and offering multiple electronic options so customers can pay without delay.

It also means requiring deposits that cover upfront costs, aligning contract milestones with actual expenses, and enforcing change order billing so projects never drain your reserves. At the same time, forecasting cash flow with a rolling 13-week plan helps you anticipate tight weeks before they happen and adjust purchasing or staffing accordingly.

On the payables side, scheduling vendor payments strategically, on due dates, not early, preserves liquidity, while negotiating better terms or capturing supplier discounts improves margins.

With the right systems, automation tools like DepositFix, and strategic coaching from experts such as Natalie Luneva, trade businesses can create a predictable cash cycle that funds growth, protects credit, and keeps crews and vendors paid on time.

Key Takeaways

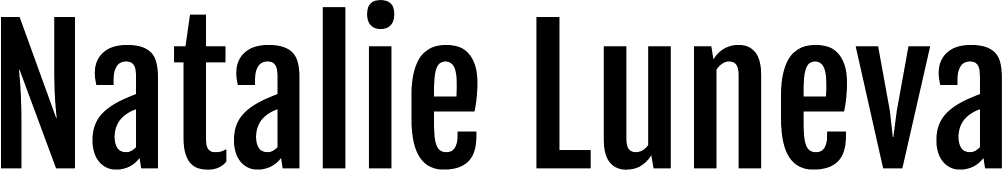

- Healthy cash flow is the foundation that keeps payroll, suppliers, and daily operations running smoothly in any trade business.

- Faster invoicing and clear payment terms shorten the gap between work completed and money received.

- Forecasting with discipline, like a 13-week rolling plan, helps spot timing gaps before they cause strain.

- Strategic payables management preserves liquidity while maintaining strong supplier relationships.

- Combining Natalie Luneva’s coaching with DepositFix automation creates a powerful system for predictable and profitable cash flow.

Why Cash Flow Management Matters for Trade Businesses

When receipts lag, routine purchases and payroll can quickly tighten operating funds. You face tight margins, seasonal peaks, and long receivable cycles that raise risk for insolvency.

Adequate cash preserves vendor ties and keeps crews working. That means you can buy parts, service equipment, and avoid using personal credit for daily needs.

External pressures, rising rates, inflation, and market shifts change how much working capital you need. Small delays in customer payments can push you short on fuel, payroll, insurance, and supplier bills.

- Keep reserves for slow seasons and unexpected repairs.

- Align jobs with available funds so stock and labor aren’t overextended.

- Set clear payment terms and offer quick electronic options to shorten collection cycles.

Diagnose Your Cash Position and Forecast Like a Pro

Map each incoming dollar and outgoing bill so you can spot tight weeks before they arrive. Separate operating receipts and payments from financing and investment moves. That clarity shows what actually funds day-to-day work.

Build a 13-week rolling forecast that captures seasonality, scheduled jobs, materials lead time, and payroll cycles. Include booked income, pipeline probability, and approval delays so your plan reflects real collection timing.

- Use an invoices and receivables aging report to flag slow accounts and days of sales tied up.

- Model timing gaps: orders placed, supplier bills received, and customer payment dates.

- Forecast key expenses, fuel, insurance, subcontractor labor, and add variability to size your buffer.

Document payment milestones and retention holdbacks for larger contracts. Define escalation triggers (for example, reserves below two payrolls) so you make prompt decisions on purchases, staffing, or collections.

| Category | Includes | Action |

| Operating | Sales receipts, payroll, materials | Track weekly; reconcile against forecast |

| Financing | Loans, equity, repayments | Schedule cash impacts; avoid surprises |

| Investing | Equipment buy/sell | Plan timing and test buffer needs |

Review the forecast weekly, compare actuals, and adjust purchasing, staffing, and scheduling to keep predictability high.

How to Improve Cash Flow in a Trade Business through Faster Receivables

Quick invoicing and firm rules reduce lag between work completed and funds received. Clear processes speed collections and cut back-office time.

Define payment terms clearly

State due dates and late fees on every invoice and list accepted payment methods. Offer small early payment discounts that encourage faster remittance without hurting margins.

Send invoices immediately and standardize billing

Issue an invoice the same day work ends or a milestone clears. Use a single template and plain language so customers know exactly what to pay and when.

Accelerate collections with automation and electronic options

- Set automated email and SMS reminders tied to invoice aging.

- Enable cards, ACH, and field POS so payments happen on the spot.

- Link remote payment links on every bill to shorten the collection cycle.

Screen customers and enforce policies

Run a simple credit check before onboarding non-cash accounts. Require signed acceptance of payment terms and set limits or deposits for higher-risk accounts.

| Action | Benefit | Timing |

| Immediate invoicing | Shorter receivables; faster access to cash | Same day as work completion |

| Automated reminders | Less manual follow-up; higher on-time payments | Pre-due, due, and post-due schedules |

| Multiple payment options | Higher conversion at point of service | During service or with invoice |

| Credit checks & deposits | Lower write-offs and chronic late payers | Before first large job |

Price, Deposits, and Contracts that Protect Your Cash

Set deposits and pricing so each job funds its next mile of work without surprises. Base the upfront amount on real expenses, materials, permits, and labor, that you will incur before the next payment milestone. This reduces your exposure and keeps vendors paid.

Change deposit rules: stop using flat percentages. Calculate the amount that covers lead times and supplier terms. Align payments with procurement so you have funds before ordering long-lead items.

Contract language and change orders

Update contracts to state payment deadlines, accepted payment methods, and penalty terms. Add early-payment incentives where they make sense. Include escalation clauses for long projects so rising costs don’t erode margins.

- Implement a strict change order process that creates immediate invoices for scope shifts.

- Use job costing to compare estimates with actuals and refine future pricing.

- Standardize proposals so customers know what is included, which reduces disputes.

| Focus | Action | Result |

| Deposit amount | Calculate by upcoming expenses | Less out-of-pocket spending |

| Contract terms | Spell out deadlines and penalties | Fewer disputes, faster payments |

| Pricing tests | Review past jobs and quotes periodically | Protected margins, steady income |

Be Strategic with Payables and Supplier Relationships

Smart scheduling of bills preserves available funds while keeping vendor relationships intact. Plan payments on due dates so money stays in your account until it’s needed. Shift payment earlier only when a supplier discount exceeds your cost of credit.

Negotiate terms that match receipts: net 30/45/60, partial deposits, or progress billing. Form or join buying cooperatives with other businesses to win volume pricing and lower unit costs.

- Pay electronically on the day bills are due to avoid float loss and late fees.

- Keep friendly, regular communication with suppliers for priority allocation and better terms.

- Consolidate vendors where it raises leverage, but keep backups to prevent shortages.

Review contracts yearly and consider extended terms for equipment or large orders that protect your bottom line while meeting project timelines. Set approval thresholds and a payable calendar so nothing slips, and track discount capture rates against your financing costs to guide decisions.

| Action | Benefit | When to Use |

| Pay on due date electronically | Preserves available funds; avoids float | Standard recurring bills |

| Accept early-pay discount | Reduces costs if savings exceed financing cost | High-volume or critical supplier offers |

| Join buying cooperative | Lower unit costs via volume | When multiple businesses share needs |

| Negotiate extended equipment terms | Keeps cash for operations while securing assets | Large purchases with long lead times |

| Track discounts vs. cost of capital | Data-driven payment choices | Monthly payable reviews |

Control Inventory and Equipment Costs without Starving Cash

Routine checks reveal excess stock you can convert into ready funds. A short audit frees space and reduces carrying expenses while keeping service levels steady.

Audit stock and move slow inventory to free tied-up cash

Quarterly reviews expose dead or slow-moving items. Liquidate these lines, even at a discount, so cash returns to operating accounts.

Lease versus buy: preserve working capital and consider capital lease options

Leasing spreads payments and protects working capital. Capital leases can offer ownership at term end, balancing near-term financing needs with longer-term investmYes. Faster invoicing, clearer payment terms, early payment incentives, and stronger receivables management often reduce the need for financing. Inventory audits and leasing equipment instead of buying also free up cash.ent value.

Standardize parts lists to reduce waste and manage costs

- Set min/max levels for common parts based on actual usage.

- Standardize materials across jobs to simplify procurement and cut waste.

- Tag high-value items and keep a parts catalog so crews check stock before ordering.

- Track shrinkage and write-offs in accounts and train crews to handle materials responsibly.

| Action | Benefit | When |

| Quarterly audit | Frees cash and space | Every 3 months |

| Lease major units | Preserves working cash | When uptime and liquidity matter |

| Standard parts list | Lower expenses and faster service | Ongoing |

Upgrade Payment Solutions to Speed Money in

Field payment tools let your crew convert completed work into immediate receipts. That reduces lag between finishing a job and having usable funds in your account.

Offer several payment options on every invoice and at the point of service. Use mobile POS for cards and ACH so crews can collect on site. Add remote deposit capture for checks so deposits clear faster without bank trips.

Make paying effortless for customers. Embed “pay now” links and QR codes on invoices. Enable online bank transfers and instant card entry. Configure automated reminders and receipts so clients stay informed and disputes fall.

- Accept cards and ACH via mobile POS at job completion for immediate receipts.

- Deploy remote deposit capture so checks post the same day without travel.

- Present multiple options, card, ACH, bank transfer, on every invoice.

- Embed pay links and QR codes to remove friction and reduce abandonment.

- Automate reminders and confirmations to speed collections and cut admin time.

Monitor and optimize. Track authorization rates, chargebacks, and processor settings. Weigh card fees against faster inflows and adjust pricing or terms to protect margins. Train staff to ask for payment confidently and standardize the payment process so everyone follows the same steps.

| Solution | Benefit | When to Use |

| Mobile POS (cards & ACH) | Immediate receipts; fewer outstanding invoices | At job completion |

| Remote deposit capture | Faster check posting; less downtime | When clients still issue checks |

| Embedded pay links & QR | Lower abandonment; faster online payments | With all emailed or printed invoices |

| Automated reminders | Higher on-time payments; less manual follow-up | Pre-due, due, and post-due schedules |

Expand Access to Cash while Building Healthy Reserves

A measured mix of borrowing and saving keeps operations steady when receipts lag. Use external financing sparingly and build a reserve that cushions payroll and bills.

Use lines and working capital financing prudently

Establish a revolving line before you need it. Draw only for short timing gaps. Compare LOCs, working capital loans, and credit cards by cost, speed, and flexibility.

- Prioritize paying down high-cost debt once receivables post.

- Monitor covenants and utilization during slow months.

- Time draws and repayments using your rolling forecast.

Park excess funds in higher-yield accounts

Automate transfers when operating balances exceed thresholds. A high-yield savings account grows liquidity above standard checking while keeping funds accessible.

| Option | Use Case | Speed | Cost |

| Revolving LOC | Short-term gaps | Fast | Moderate |

| Working capital loan | Planned seasonal needs | Moderate | Variable |

| Business credit card | Immediate small expenses | Instant | Higher APR |

| High-yield savings | Reserve growth | Immediate access | Low (opportunity cost) |

Improve Cash Flow for Your Trade Business with Natalie Luneva & DepositFix

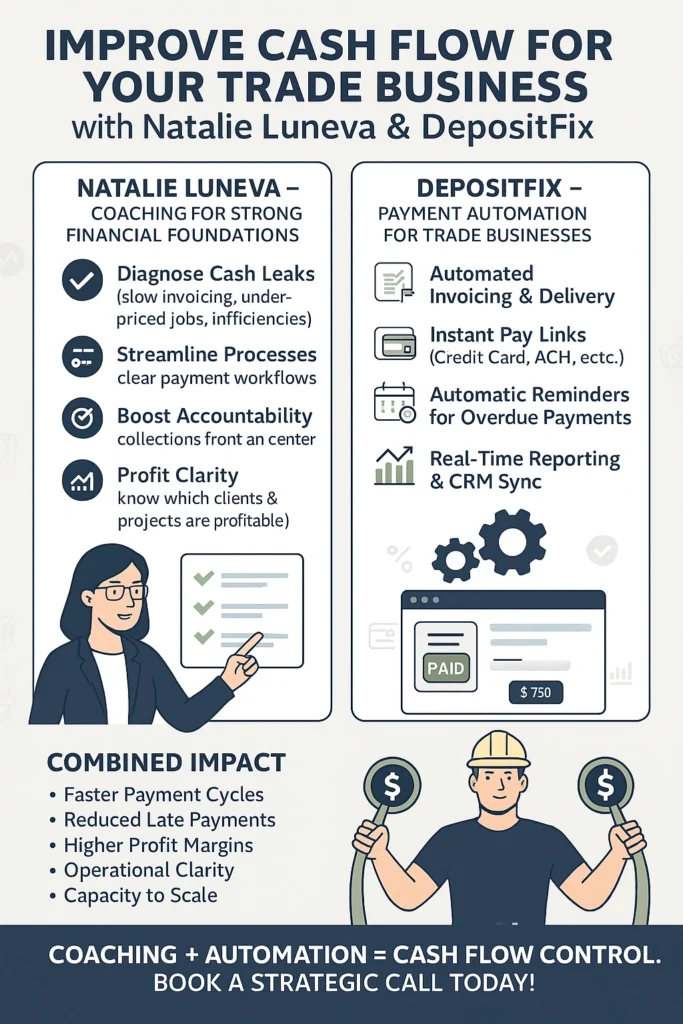

Whether you’re running an HVAC crew, roofing company, plumbing business, or any skilled trade, cash flow is the lifeblood of your operation. With Natalie Luneva’s coaching expertise and DepositFix’s payment automation tools, trade businesses can create a more reliable, streamlined revenue engine. Here’s how:

How Natalie Luneva’s Coaching Strengthens Your Financial Foundations

Natalie Luneva specializes in helping blue-collar business owners unlock profit through systems, strategy, and clarity in operations. Natalie Luneva With her guidance, trade business owners can:

- Diagnose cash leakages (slow invoicing, inefficient workflows, underpriced jobs)

- Architect process flows that ensure payments stay on track

- Build accountability systems to keep collections front and center

- Gain clarity on which clients, projects, and pricing structures drive true profitability

Her coaching transforms reactive cash-flow scrambling into a proactive, predictable system.

How DepositFix Supercharges Payment Collection & Cash Handling

DepositFix is a payments platform that automates invoicing, payments, and reminders, directly integrated into your CRM or system. It helps trade businesses close the gap between work done and cash in hand by:

- Automating invoice generation and delivery

- Embedding payment links directly inside invoices (so clients pay instantly)

- Accepting multiple payment types (credit card, ACH, etc.)

- Triggering reminders for overdue payments automatically

- Syncing payment data with your CRM or bookkeeping systems

- Offering real-time reporting and cash flow visibility

With DepositFix, you cut down on the friction, delay, and errors that often stall collections.

The Synergistic Impact: Coaching + Automation = Cash Flow Control

When you combine Natalie’s coaching and DepositFix’s automation, trade businesses can expect:

- Faster payment cycles — invoices go out automatically, clients can pay immediately

- Reduced late payments and bad debt — reminders and seamless pay links reduce friction

- Higher operational clarity — you see exactly where money is stuck, and why

- More capacity to scale — systems replace manual chasing, freeing you to grow

- Stronger profit margins — better pricing, fewer write-offs, more consistent cash

Natalie helps you build the strategy, the processes, and the mindset. DepositFix makes sure the execution, billing, collection, and reporting happen reliably. Together, they give your trade business the cash flow stability it needs to thrive. Book a strategic call today!

Conclusion

Improving cash flow in a trade business is about creating the stability that keeps crews working, suppliers confident, and growth possible. When you tighten receivables, set clear terms, manage payables strategically, and forecast with discipline, you can smooth out the ups and downs that often strain operations.

Tools like DepositFix help you collect payments faster, while coaching from experts like Natalie Luneva equips you with the strategy and systems to sustain long-term financial health. With both practical tools and strong management habits, your trade business can maintain healthy liquidity, protect profitability, and build the confidence to take on bigger opportunities.

FAQs

What is the difference between cash flow and profit in a trade business?

Profit is the difference between revenue and expenses on paper, while cash flow reflects when money actually enters and leaves your bank account. A trade business can be profitable on paper but still struggle to pay vendors and staff if receivables lag behind payables.

How often should trade businesses review their cash flow?

Weekly reviews are best for most trade businesses. A rolling 13-week forecast combined with weekly reconciliations helps spot tight periods early and keeps decisions proactive rather than reactive.

Should trade businesses require deposits before starting work?

Yes, deposits protect liquidity, as they cover upfront expenses like parts, permits, and labor. The deposit amount should match expected early costs rather than using a flat percentage, ensuring your business isn’t funding jobs out of pocket.

What tools can help automate cash flow management?

Tools like DepositFix handle invoicing, reminders, and payment processing. Pairing it with accounting or CRM software creates real-time visibility, reduces manual chasing, and accelerates collections.

Can trade businesses improve cash flow without borrowing money?

Yes. Faster invoicing, clearer payment terms, early payment incentives, and stronger receivables management often reduce the need for financing. Inventory audits and leasing equipment instead of buying also free up cash.

How can coaching support better cash flow management?

A coach like Natalie Luneva helps identify leaks, refine processes, and set accountability systems. This guidance transforms cash flow management from a reactive scramble into a strategic, predictable system aligned with long-term growth.