Overdue invoices are bills that haven’t been paid by the agreed deadline, and if left unchecked, they can strain your cash flow and disrupt operations. To handle them, set clear payment terms upfront and send polite reminders as soon as a due date passes. If payment still doesn’t arrive, follow up with firmer messages or a quick phone call to resolve any issues directly.

Make payments easier with multiple options, and when necessary, enforce late fees or negotiate a payment plan. If all else fails, collections or legal action may be needed, but those should remain last resorts.

Key Takeaways

- 60% of bills are paid late; early action matters.

- Prioritize by age and balance to protect cash flow.

- Start reminders the day after due and keep a steady cadence.

- Use email, phone, and mail with clear payment details.

- Adjust tone over time and know when to escalate.

Understanding Past Due and Overdue Invoices

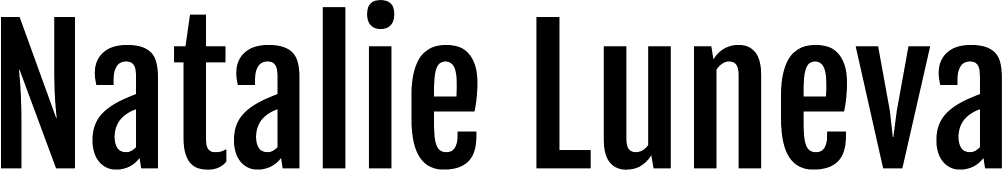

Clarify when a customer balance becomes past due and how that status can strain daily operations. A past due or overdue invoice is any bill unpaid after its agreed due date. That status signals you to act quickly to protect cash flow and operations.

What “Overdue” Means and Why it Matters for Cash Flow

When a payment misses its due date, the risk of nonpayment rises with every day. Late payments tie up working capital, increase admin time, and limit funds for payroll or purchases.

Standard Payment Terms, Due Dates, and Days Past Due

Most firms use clear payment terms like Net 15, Net 30, or Net 45 and include an invoice date so the due date is unambiguous. Track days past due (1–7, 30/60/90+) to prioritize collection work.

- Key invoice fields: invoice number, amount, invoice date, due date, payment terms, and payment instructions.

- Set late fee policies in writing during onboarding and follow state law to avoid surprises for customers.

- Use consistent language in each reminder and define internal stages to trigger the right action on time.

Diagnose the Problem: Prioritize Accounts and Assess Risk

Begin with a snapshot of aged receivables to see which accounts demand immediate work. Build a ranked view that shows total amount by account and buckets days past due so you can spot the danger zone, balances over 90 days lose recovery odds fast.

Flag common causes like billing errors, missing contacts, disputed line items, or PO mismatches. For each account, record the root cause and the next action so your team moves quickly.

- Sort by amount and days past due to prioritize high-impact accounts.

- Filter out accounts with steady payment behavior and focus on repeated late payers or large unpaid invoices.

- Log customer signals, broken promises or “invoice not received” claims, to escalate sooner.

Align account owners and finance on one dataset. Set SLAs for dispute responses and keep a checklist confirming the invoice was delivered and acknowledged before escalating. Track which interventions work by account type and amount to refine future priorities.

| Risk Tier | Days Past Due | Typical Amount | Recommended Action |

| High | 91+ days | $10,000+ | Immediate escalation; involve account manager |

| Medium | 31–90 days | $1,000–$9,999 | Phone call, verify disputes, set payment plan |

| Low | 1–30 days | Under $1,000 | Automated reminders and follow-up |

Build a Follow-up Cadence that Gets You Paid

Create a simple schedule that nudges payment without overloading your customers or your team. A clear cadence reduces friction and cuts the typical days past that drag on cash flow.

Start the day after the due date with a brief reminder that includes the invoice number, amount, and a one-click payment option. If nothing happens, send follow-ups at 30, 60, and 90 days for most accounts.

For reliable customers, wait a week or two before the first nudge. For chronic late payments, tighten the rhythm to every 10–14 days. Batch messages to save time and use tools like Boomerang to resurface unreplied emails.

Choosing Channels: Email, Phone, and Snail Mail

Begin with email, then add a phone call after 2–3 unanswered reminders. Track opens with Mailtrack and consider mailed notices when email goes ignored.

Timing and Subject Lines that Drive Action

Send on Tuesdays around lunch or on weekends to stand out. Use clear, neutral subject lines that set expectation without sounding hostile, include the number and amount so recipients know this is actionable.

- Keep messages short: invoice summary, due date, amount, and payment options.

- Log each touch on the account so the next owner sees the last action and next step.

- Include a direct phone number and invite a quick call to unblock issues fast.

| Timing | Channel | Message Focus | Action |

| Day after due date | Friendly reminder with invoice number and amount | One-click payment link; log action | |

| 10–14 days (if chronic) | Email + Phone | Clear subject line; verify disputes | Call after 2 emails; offer payment options |

| 30 / 60 / 90 days | Email, Phone, Snail mail | Escalating tone; summary of days past and balance | Involve account manager; consider formal notice |

Write Effective Reminders and Past Due Notices

Well-crafted messages that include exact references remove excuses and speed payment. For every reminder, include the invoice number, invoice date, due date, amount, payment terms, and a direct payment link. Attach the PDF so the recipient cannot claim they never received the documents.

Your first reminder should be polite, plain text, and sent from a real person. Personalize with the customer’s name and any recent conversation. Short, friendly language, “please” and “thank you”, boosts response rates.

Test subject lines and subject formats to find what works. Try clear, specific lines (example: “[Your Company]: $200 amount due, pay online in 1 minute”). Shift tone as days pass: firm at 60+ days, urgent later.

- Always include: invoice number, date, amount, due date, payment links, and terms.

- State late fees only if agreed up front; list any fees applied and comply with state law.

- Offer a payment plan when customers show cash constraints and ask for transaction references when payment is in progress.

| Stage | Tone | Action |

| Day after due date | Friendly | Plain-text reminder, PDF, one-click pay |

| 30–60 days | Firm | Phone follow-up, offer plan |

| 90+ days | Urgent | Escalate to account manager or formal notice |

Close each message with thanks and a direct line for questions. Keep template versions for day-after, 30/60/90, and final notices to ensure consistent quality across your business.

Make Payment Easier: Options, Payment Plans, and Late Fees

Reduce friction and offer several fast, secure ways to pay. List clear payment options on every reminder and document so customers know exactly how to settle a balance. Include ACH, credit card, online portal links, and a check option.

Offer a simple payment plan for larger balances. Split amounts into scheduled installments with specific dates and automatic debits. Confirm any plan in writing and state consequences for missed payments.

Be transparent about late fee policies. Put fees in the contract and follow state law. Show calculations clearly (for example, 1.5% per month = 18% annual) and list fees as a separate line item.

Use invoicing software to automate reminders, apply pre-agreed fees, and collect payments via secure checkout. Include a direct billing contact so questions get resolved quickly. Review which options drive the fastest payment and standardize those in your process.

| Feature | Why it helps | How to implement |

| Multiple payment options | Reduces friction and speeds payment | Show ACH, card, portal link, and check on every document |

| Payment plans | Improves recovery on large balances | Written schedule, automatic debits, and confirmation |

| Transparent fees | Sets clear expectations and legal compliance | Include fee policy in contract, show separate line item, automate with software |

Overdue Invoices Escalation: Calls, Account Managers, and Letters

Escalation should be clear, chronological, and professional. After 2–3 unanswered reminders, move to a call with exact details ready: invoice numbers, amounts, and dates. Follow that call with an email the same day to document any commitments and next steps.

Phone Scripts that Unblock Issues Fast

Use a short script that cites specific invoice numbers and the total amount. Ask open questions like, “What’s blocking payment?” and offer immediate options or a short payment plan.

- State the due invoice, date, and amount upfront.

- Ask one open question and propose one clear solution.

- Confirm the next action and send a same-day follow-up email.

Involving Sales and Account Managers to Protect the Relationship

Bring an account manager in when the customer hints at a service dispute. Sales teams can often clear internal approval barriers and preserve the customer relationship.

Log each touch so accounts teams see the history and can act fast.

Formal Demand Letters and Ehen to Consider a Collections Agency

Send a mailed demand letter that lists each due invoice, the total amount, and a firm payment deadline (for example, 15 days). Postal mail helps reach finance departments and adds weight.

If balances remain unpaid beyond 90 days and the customer is non-responsive, evaluate using a collections agency. Choose reputable agencies (search via the Better Business Bureau) and issue a final pre-agency notice before transfer.

- Track outcomes of calls, letters, and agency actions to improve your escalation playbook.

- Escalate tone in writing and state days past due and the next action clearly.

Prevent the Next Overdue Invoice with Process and Software

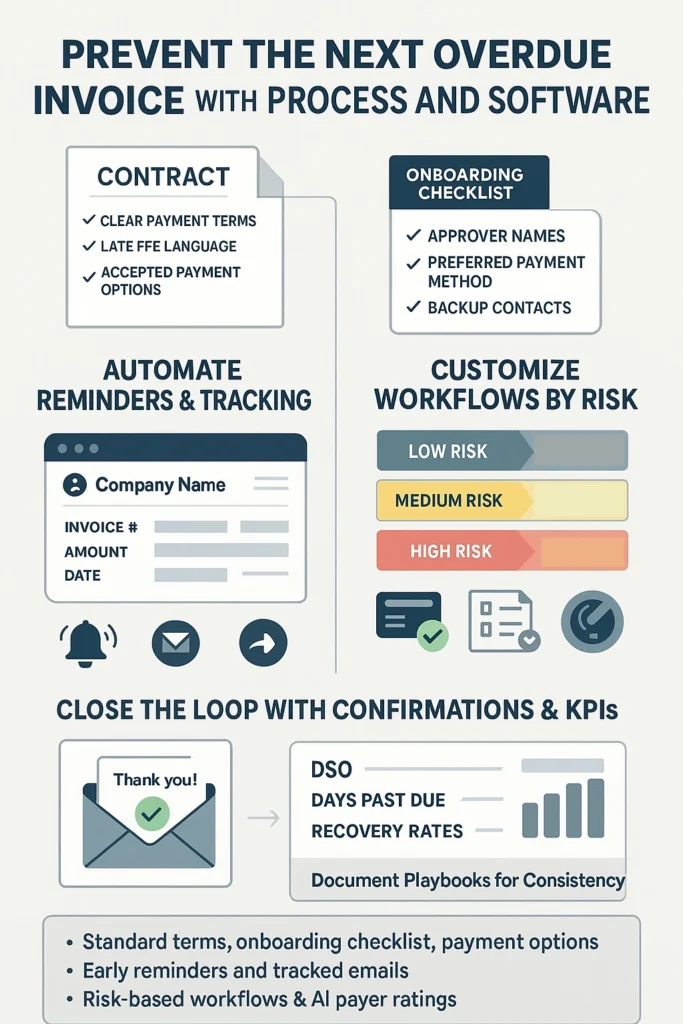

Put strong processes in place before a bill is sent, and let expert support and technology drive consistency. Natalie Luneva, with over 10 years in marketing and operations, helps blue-collar business owners unlock profit through smart systems, strategy, and clarity, giving you the insight to establish clear contracts, strong onboarding, and disciplined billing routines.

Meanwhile, DepositFix is a powerful tool to automate and streamline your invoicing and payment workflows. With DepositFix you can generate invoices automatically, accept payments via multiple gateways (Stripe, PayPal, etc.), track revenue and aging reports, send automated reminders, and integrate analytics so you always know which invoices are open, overdue, or at risk.

To pull it all together, here are some refined practices combining process + Natalie’s guidance + DepositFix software:

- Define and standardize payment terms up front (due dates, late fees, accepted methods) with contracts set up under Natalie Luneva’s system strategy.

- Onboard each customer using a checklist: approvers, payment preferences, backup contacts.

- Use DepositFix to automate reminders (pre-due, overdue), track when invoices are opened, and send follow-ups automatically, reducing manual chasing.

- Segment clients by risk: view payer-behavior via DepositFix analytics, or apply stricter terms or prepayments for higher-risk customers.

- Review your metrics monthly (DSO, recovery rate, days past due) with DepositFix dashboards, under Natalie’s framework, and document workflows so the process is repeatable.

If overdue invoices are slowing down your growth, now’s the time to put the right systems and tools in place. Book a strategic call to get expert guidance on optimizing your invoicing process, and see how pairing her strategies with DepositFix software can help you get paid faster, with less stress.

Conclusion

A short, consistent playbook cuts days past and keeps cash moving. Use a checklist so each due invoice has a clear number, amount, and next step. Track days past and prioritize accounts that need fast attention.

Make payment easy. Offer multiple payments and a simple payment plan when needed to help get paid faster. Use a clear subject line and concise message so customers act without delay.

Be transparent about any late fee and list fees in your terms. Document calls and emails before you consider an agency.

Maintain professionalism and measure results. This approach will shorten collection time, recover more invoice balances, and stabilize your cash flow.

FAQs

How long should I wait before contacting a client about an overdue invoice?

You should reach out the day after the due date with a polite reminder. Waiting too long signals that late payment is acceptable and increases the risk of nonpayment.

Can I charge interest or late fees on overdue invoices?

Yes, but only if it’s clearly stated in your contract or payment terms and compliant with local laws. Without prior agreement, adding fees could create disputes.

What should I include in an overdue invoice reminder email?

Always include the invoice number, due date, amount owed, payment options, and a copy of the invoice. Keeping details clear removes excuses for delay.

Should I stop providing services to a client with overdue invoices?

If a client repeatedly fails to pay, it’s reasonable to pause future work until past invoices are settled. Just make sure your contract allows you to suspend services.

Is it better to handle overdue invoices manually or with software?

Software is more efficient, it can automate reminders, track days past due, and record communication history. Manual tracking often leads to missed follow-ups.

When is it appropriate to use a collections agency?

Collections should be considered when an invoice is over 90 days overdue and the client is unresponsive. It’s a last resort since it may damage the relationship.